GIG WORKERS IN THE REGION

In the last decade, the world, along with numerous problems and global challenges – from the latest one caused by the war in Ukraine, the still present consequences caused by the Covid-19 pandemic, climate change and economic crises – experienced an unprecedented growth of digital labor markets. Disruptive changes brought about by the rise of information and communication technologies generated large-scale innovations that stimulated fundamental changes in the field of work and worker’s qualifications – although according to the World Bank it is a “quiet revolution”, it is also quite radical – in the world, according to some estimates, around 163 million gig workers are active.

This created completely new opportunities for business, social progress, growth in the well-being of individuals and their freedoms. Numerous challenges have also emerged: in the domain of fairness and opportunities for dignified work, job security in the newly created environment, and challenges related to a poorly or generally unregulated work environment. Further, there has been an increasingly pronounced polarization between developed and underdeveloped countries, uneven distribution of opportunities for digital work between urban centers and rural areas, and unequal distribution of income. Considering that the positive aspects dominate when it comes to the digital labor market, estimates are that the global market for such labor will reach a value of US$ 72.2 billion by 2026, growing 21.3% per year.

The regional edition of Gigmetar was created with the aim of monitoring development in the digital labor market in Southeast Europe, which includes two countries that stand out in global statistics when it comes to the concentration and number of talent in the field of gig work – Romania and Serbia. According to the number of gig workers relative to the number of inhabitants, North Macedonia, Montenegro and Bosnia and Herzegovina also have a very dynamic digital labor market.

The goal of the Gigmetar project is to determine the systemic characteristics of the gig worker market in the Southeast European region, their similarities and differences, as well as to identify the key regional trends and changes that are occurring over time. The latest measurement points to the return of a trend that has been present since Gigmetar has been created, and which was interrupted in the previous year: namely, the strong expansion of the digital labor market that was present in previous years has continued! In the latest measurement, the market, measured by the population of registered gig workers on the three most popular platforms in the region, Freelancer, Upwork and Guru, grew by more than a quarter (26.4%), which is a huge leap compared to the one-year stagnation in the previous two measurements.

HIGHLIGHTS

A large increase in the number of gig workers was recorded on all three platforms – Freelancer (49.2%), Guru (44.4%) and Upwork (12.6%).

In all countries, an increase in the number of workers was recorded on all platforms, except for Guru, where the number of workers from Bulgaria and Romania declined.

Upwork remained the dominant platform, but with a decrease in relative importance – it is dominant in 7 out of 9 countries, and experienced a decline in market share of 5.5%.

The highest growth on all platforms was recorded in Hungary – the population increased by 58.3%.

The trend of decreasing the relative number of gig workers in the field of software development and multimedia and creative services continued in all countries, while the most dynamic growth in most countries of the region was recorded in the field of writing and translation (4 out of 9 observed countries).

Serbia has the most active gig population – at the time of measurement, 20.2% of the total population of gig workers worked.

A decrease in the share of women was recorded in all countries of the region, but it is still above the world average – Albania (41.3%) and North Macedonia (40.1%) have the largest share of women in the region.

The trend of a slight increase in wages at the regional level and the reduction of the gender gap continued – women on average earn 85.3% of men’s wages.

LEADING PLATFORMS

The leading global platforms in Southeast Europe in terms of the number of registered gig workers are Upwork, Freelancer and Guru. In the latest measurement 130,612 workers were registered in the observed 9 countries of the region.

Extensive growth in the population of gig workers – the population has increased by more than ¼ (26.4%), lead to the increase of the number of gig workers on all platforms and in all countries has. The exceptions are Bulgaria and Romania, where the total number of workers also increased, but on one platform (Guru) it declined. Another significant change relates to the different intensity of growth, which had consequences for the market shares of individual platforms.

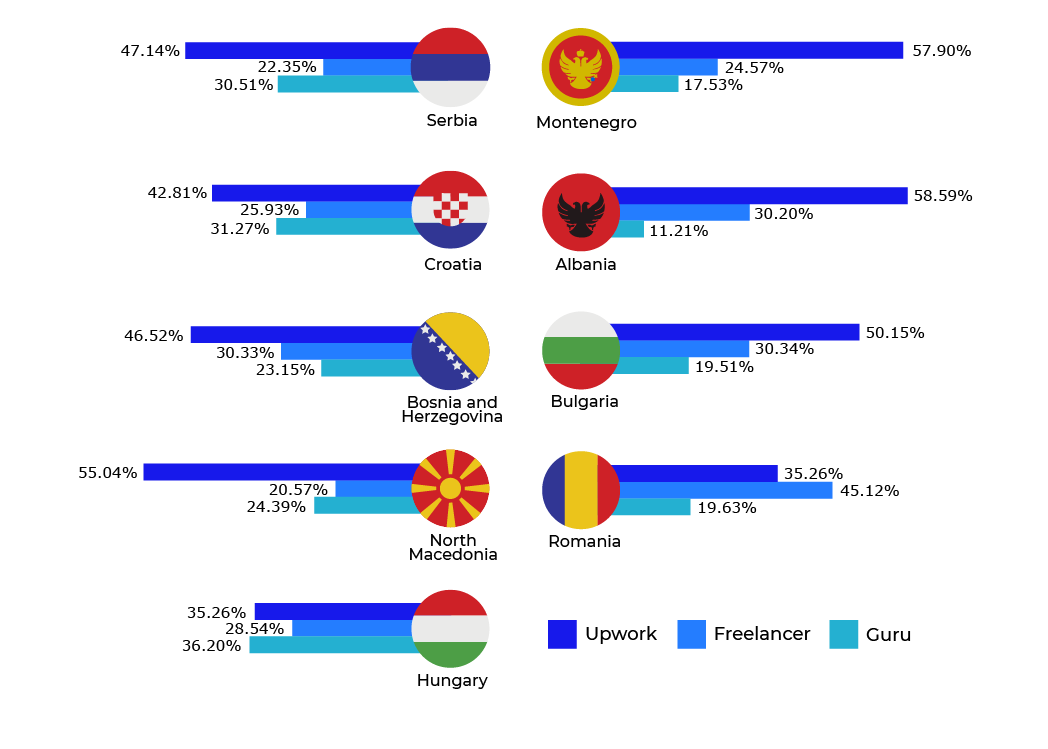

In the distribution of gig work, the dominant regional position is still held by Upwork with a market share of 45%. Freelancer and Guru follow with 30.6% and 24.4%. Although the latest measurement did not bring significant changes when it comes to the market shares of the three observed platforms, there were still some shifts. Upwork continues to dominate and it is the most popular platform (in 7 out of 9 countries), which is a significant change compared to the previous measurement where it was the most represented platform in all countries. Read more ...

Upwork’s far slower growth compared to Freelancer and Guru has seen its share of the gig market drop by more than 5 pp to 45%, while Guru has seen a more moderate decline (4.4 pp) and now has a market share of 24.5%. The absolute winner is Freelancer, where the population in all countries recorded a huge growth – regional average of 49.2%, which also increased its share in the labor market to 30.6%. These results deny the often emphasized advantage of dominant market players on technological dependence, i.e. that once established a dominant position on the market provides long-term strategic advantages. Freelancer has become the dominant platform in Romania, while in Hungary this is the case with Guru.

In the latest measurement, the weakest growth intensity of the gig population was recorded on Upwork – 12.6%. On the other two platforms, a far more significant population growth was recorded – on Freelancer the population increased by almost half (49.2%), and on Guru a little less (44.4%). It is interesting that in the latest measurement, Hungary had the strongest growth of the gig population on all three platforms – in particular, Guru (90.5%), Freelancer (64%) and Upwork (31.8%). On the other hand, Bulgaria is the country that had the most modest average growth in the number of gig workers on all three platforms (8.4%), which was largely caused by the decline in the number of gig workers on Guru (26.6%).

The following factors are taken into account when it comes to the accuracy of our estimates. The first refers to the change in the methodology of displaying workers on different platforms, and the second to the existence of multiple profiles of (the same) gig workers on (different) platforms. The second problem is not of major importance, because the platforms are interested in displaying only those workers who are really available to potential employers, and therefore update their gig worker databases relatively regularly and/or according an improved methodology. Thus, although a certain number of workers have profiles on several platforms, this does not disturb the estimates of the realistically available labor force, because we observe workers who are active. However, the existence of double or multiple profiles affects the accuracy of the estimation of the actual number of gig workers in the region.

SHARE OF GIG WORKERS BY COUNTRY AS % OF REGIONAL TOTAL

The systemic characteristics of the gig work market, which are related to their geographical dispersion, professions, gender, income and related distributions, were observed in relation to the dominant platform in the region – in according to the latest measurement, the most represented in 7 out of 9 countries, but also the largest in terms of number of workers – accounting for 45% of the total number of gig workers. Upwork maintained its dominant position among the three most popular digital platforms in the region, but with a relatively significant decline of its market share – 5.5 pp. However, the decline in Upwork’s share is not the result of a decrease in the population of gig workers on it, but the fact that on the other two platforms the number of gig workers increased to a much greater extent. That’s a particularly significant result given the business challenges Upwork faces.

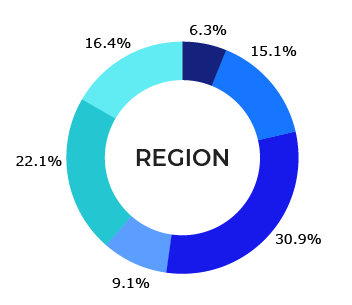

Even in the most recent measurement, the dominant growth in the number of gig workers came from countries that have a smaller population of gig workers. The proof of this is that in the countries where their population is the most numerous – in Serbia and Romania, there was a further decrease in the relative participation at the regional level. It declined to 43.6% in these two countries. Read more ...

In the previous measurement, the acceleration of growth recorded on Upwork (16.4%) continued in an almost undiminished intensity in the previous 6 months – the growth was 12.6%. It points out to a big change in dynamics that has been present in the past year compared to the earlier period, when growth rates were much more modest. At the same time, the position and relative share of Serbia remained identical – it is still the dominant destination of the largest number of gig workers on Upwork in the region – it is still home to 24.3% of the regional population of gig workers on this platform.

If we observe the movement of the number of workers by country in relation to the previous measurement from the aspect of changes both within countries, but also according to the share of a specific country in relation to the population of gig workers in the region, two main changes are present.

All countries recorded an increase in the number of gig workers. However, significant growth was achieved only in Hungary (31.8%), while in other countries the growth was in double digits (Albania – 21.9%; Montenegro – 16.1%; Serbia – 12.5%; Croatia – 11, 7%; North Macedonia – 10.7%; Bulgaria – 10%), i.e. single digits (Bosnia and Herzegovina – 9.3%; Romania – 6%).

The share of countries in the total number of gig workers in the region has not changed significantly compared to the previous measurement. This data points to the fact that in all countries of the region there was a relatively uniform influx of labor.

NUMBER OF GIG WORKERS PER 100,000 POPULATION, BY COUNTRY

In order to compare the development of the gig market as accurately as possible, and in order to neutralize the difference in the size of the countries, the following graph shows the relative number of gig workers in relation to the size of the country, i.e. the number of inhabitants. Contrary to the previous measurement, when Bosnia and Herzegovina recorded a decrease in the number of gig workers according to this indicator, in the latest measurement, an increase was recorded in all countries. However, growth was not evenly distributed across countries.

Largest increase in the number of gig workers per capita is recorded in Albania, while North Macedonia maintained the dominant position in the region according to this indicator (331 gig workers).

In the most recent measurement, Albania is the second country in the region in terms of the relative number of gig population thanks to the growth of this indicator by 22% – with 222 gig workers/100,000 inhabitants, which pushed Serbia to the third/fourth place, which has 208 gig workers/100,000 inhabitants, as much as Montenegro. Other countries in the region, with the exception of Bosnia and Herzegovina to some extent, have a much smaller population of gig workers.

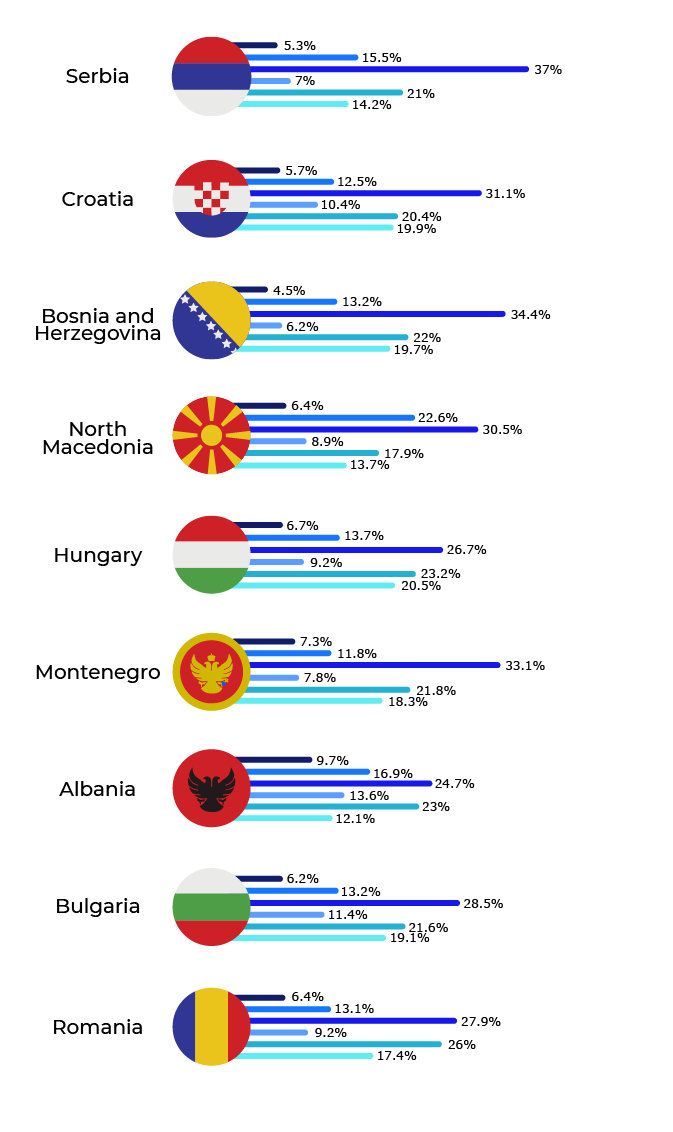

REGIONAL GIG WORKERS BY PROFESSION

In the latest measurement, there were certain changes when it comes to the distribution of workers by individual professions. In the two dominant areas – creative services and multimedia and software development, there was a further decline in the relative participation of gig workers, and a further decline in the share was recorded in the domain of professional services. Although the decline in the share is relatively small – slightly more than 1 pp and 0.7 pp respectively, a similar trend was recorded in the previous two measurements, which has significant implications for the observed further relative decrease of the gig population in the most lucrative jobs, i.e. jobs that are the best paid on a global level. This may be a consequence of both the limited supply of this labor force in the observed region, as well as the trends on the domestic labor markets, where the demand, especially in the field of software development, is high.

In the latest measurement, there were also some changes when it comes to the workers who were working on the projects at the time of the measurement. Namely, the average employment of gig workers, which we define as the percentage of gig workers who worked on specific projects at the time of measurement in relation to the total population, was 15.4%, which is an increase of 1 pp compared to the previous measurement. However, in order to neutralize the effect of seasonality, by observing this value in relation to the same period last year – when the average employment was 17.9% at the regional level, we come to the conclusion that in the previous year the number of active gig workers decreased (by 2 ,5 pp), i.e. population of gig workers who were working at the time of measurement. The reason for this is, in part, the large number of new gig workers who find it harder to find jobs. Read more ...

Serbia, as in previous measurements, has the most active gig population (20.2%), but there has also been a decline in the working population since latest measurement (2,1 pp). The lowest number of working people, as in previous measurements, was engaged in Albania – 9.4% with a slight increase (0.6 pp). In other countries, the percentage of employment varies between 12.3% and 17.1%. The absolute differences between the countries are even more pronounced – according to the employment of the workforce, Serbia has 5 times bigger number of gig workers working at the time of measurement than in Albania. It is interesting that Croatia, Hungary and Albania had approximately the same number of workers working at the time of measurement. At the same time, Albania has a significantly larger population compared to the other two countries.

Out of 100 workers who were working at the time of measurement, 25 had the first job (first “gig”) they got. The countries with the highest share of workers who got a job for the first time are Albania (36 out of 100) and Hungary (32 out of 100). Serbia had only 20 gig workers for whom it was their first job out of a total of 100 workers who were working at the time of measurement.

REGIONAL GIG WORKERS BY COUNTRY AND PROFESSION

When we observe the distribution of individual professions by country, it varies significantly. If we compare the relative share that a certain profession has at the level of a specific country with the average that profession has at the level of the region, it is possible to identify comparative advantages that appear at the level of certain countries. Higher relative shares at the level of specific countries compared to the regional average indicate the fact that a specific profession is more represented in that country, which gives that country a comparative advantage in the regional context.Read more ...

Even in the most recent measurement, there was a significant absolute growth in the number of gig workers in all countries, although there are exceptions when it comes to certain professions. Namely, in Bosnia and Herzegovina and Croatia there is a decline in the number of gig workers in the field of software development, while in Bulgaria this was the case with workers in the field of multimedia and creative services. When it comes to the intensity of growth, three professions recorded significant growth – 22.2% writing and translation, 14.3% data entry and administrative services, or 12.1% marketing and sales. In contrast, more modest growth was recorded in the areas of professional services (9.4%), software development (8.1%) and creative services and multimedia (8%).

The different intensity of growth by individual professions also affected the relative shares that individual professions have at the regional level in the total gig population. Namely, in the three highest-paid professions – software development, multimedia and creative services, and professional services, the share decreased, while in the other three professions, their share increased. The changes are incremental, as in the previous measurement. However, in the last year, a trend has been observed: there is a tendency for the number of gig workers to grow faster in lower-paid industries, while in the highest-paid occupations, there is a relative decrease in the labor supply. Considering the average cost of labor and global trends when it comes to the demand for labor, these developments are unfavorable: less sophisticated jobs are in demand and pay less, while demand and earnings for technical knowledge are continuously growing.

Contrary to the previous measurement, when the growth in the region was quite unbalanced – some countries had extremely high and some low growth, in the latest measurement it was more balanced. Nevertheless, Hungary stands out as the country with the most dynamic growth in the population of gig workers – it increased by 1/3 (33.5%), and a more pronounced growth was also recorded in North Macedonia (18.2%). Countries with more moderate growth are Serbia (14.2%), Montenegro (12.9%) and Albania (10.1%), while other countries in the region had single-digit growth (Bulgaria – 9.6; Romania 9.2%; Bosnia and Herzegovina – 8.7%; Croatia – 7.3%). It is interesting that Hungary, as the country where the largest growth in the population of gig workers was present, almost doubled the population in the field of professional services (47.1%) – this is also the largest growth in a single profession in all countries recorded in the latest measurement. If we look at the fastest growing population within a certain profession, in 5 out of 9 observed countries this was the case with writing and translating (Albania – 35.5%; North Macedonia – 28.8%; Romania – 28, 3%; Serbia – 24.4%; Croatia – 14.4%), while in the other 4 cases they are different professions: apart from the mentioned professional services in Hungary, in Bosnia and Herzegovina it is the field of marketing and sales (18.5%) ), in Bulgaria it is data entry and administrative services (24.2%), and in Montenegro software development, where the population increased by almost 1/3 (32.2%). In contrast to the most pronounced growth, where with variations there is also an area at the regional level where the greatest growth is concentrated, when it comes to the weakest growth there are far greater variations: in 3 countries this is the case with creative services and multimedia (Bulgaria, Romania and North Macedonia), in 2 countries it is professional services (Albania and Montenegro) and software development (Bosnia and Herzegovina and Croatia), while two countries were completely specific (Hungary in the field of writing and translation and Serbia in the field of sales and marketing).

Comparative advantages of the countries in certain professions

When it comes to relative comparative advantages (higher share of a certain profession compared to the average in the region), Albania has a comparative advantage in two additional areas (except from areas where it has absolute comparative advantage): in data entry and administrative services and in software development. Apart from Albania, Romania and Hungary are countries that have a comparative advantage in as many as four areas. In the case of Romania, this is the case with software development and professional services, as in the previous measurement, while the new occupations are sales and marketing and writing and translation. When it comes to Hungary, apart from the mentioned of writing and translation, a more significant (relative) comparative advantage appears in the field of software development, while the relative comparative advantages are less pronounced in the fields of professional services and sales and marketing.

In the latest measurement, 3 comparative advantages each appear in Montenegro and Croatia. At the same time, comparative advantages appear only in Montenegro in professional services, creative services and multimedia and writing and translation) and they are identical as in the previous measurement. On the other hand, Croatia achieves comparative advantages in the areas of sales and marketing and in writing and translation, and the new area is creative services and multimedia.

All other countries have comparative advantages in two domains. These countries also have the most similar professional structure of the gig work market. In the case of Bosnia and Herzegovina, comparative advantages appear in creative services and multimedia, and writing and translation, while the comparative advantage in software development has been lost. Bulgaria is gaining ground in sales and marketing and writing and translation, but has lost its lead in the areas of professional services and creative services and multimedia over the past 6 months. North Macedonia achieved a new comparative advantage in the field of professional services, while maintaining its advantage in data entry and administrative services. Finally, Serbia has a slight comparative advantage in data entry and administrative services, except for a pronounced advantage in creative services and multimedia.

An overview of comparative advantages and an insight into their dynamics over time reflects the sophistication of national labor markets in the observed region. Registered changes in comparative advantages suggest that its development is not fully completed and that there are still potentials for its growth – each measurement brought changes, sometimes significant, when it comes to comparative advantages, which means that there is a continuous influx of labor of different profiles, and not in accordance with established patterns – which would be the case if the market’s growth potential was completely exhausted. On the other hand, depending on the professions in which comparative advantages are (continuously) recorded in certain countries, we can conclude about the value that these markets generate, but also the vulnerability they are exposed to in a case of disruptions in the global market. For example, in the case of North Macedonia, the very propulsive gig population and its significant growth over time should be evaluated with the fact that the dominant part of the population is concentrated in the least paid occupation (data entry and administrative services), which, in addition, is potentially affected by rapid technological changes, such as those resulting from the application of solutions based on artificial intelligence.

REGIONAL GIG WORKERS BY GENDER

The latest measurement brings a change in the trend when it comes to the gender structure of the digital labor market. There has been a decline in the share of female gig workers and now there are 358 women for every 1000 gig workers. The growth trend that had been present in the previous year and a half is now reversed. In addition, in the most recent measurement, the number of female gig workers decreased in two countries: in Croatia the decrease was more pronounced (9.2%), while in Bosnia and Herzegovina it was many times smaller (2%). In contrast, two countries recorded a large growth in the population of female gig workers: Hungary (16.5%) and North Macedonia (14.9%). In all other countries, a much more modest (single digit) growth of the female gig population was recorded. Despite the growth recorded in 7 out of 9 observed countries, their relative decline was recorded in all countries, and the most pronounced was in Montenegro (4.7 pp) and Hungary (4.1 pp). Even Hungary, where there was a significant increase in the number of new female gig workers, failed to improve the gender structure, because the growth in the number of gig workers was much higher. Despite the negative trend, with an average share of female gig workers of 35.8% in the total gig population, the observed region is still one of the leaders in the world in terms of the participation of gig workers.

It is interesting to note that only in creative services and multimedia and software development male gig workers are more numerous than female gig workers in all countries. On the other hand, in the fields of data entry and administrative services (Albania, Bulgaria, Croatia and North Macedonia) and writing and translation (Albania, Montenegro, Romania and North Macedonia) there are more gig workers in 4 countries each, while in the case of professional services and marketing and sales, this is the case in 2 countries each.Read more ...

In addition, there are also professions in which the number of gig workers and gig workers is equal in individual countries (professional services: Bosnia and Herzegovina, Montenegro and North Macedonia; data entry and administrative services: Montenegro and Hungary; writing and translation: Croatia).

When comparing the number of female gig workers to male gig workers by individual professions and at the level of countries, interesting trends can be identified. Namely, the most egalitarian country according to this criterion is Albania, where women are more numerous – in four professions (professional services, data entry and administrative services, sales and marketing, and writing and translation). This egalitarianism is somewhat violated due to the large disproportion that occurs in the other two professions – software development, where men are more than 3 times more numerous, that is, creative services and multimedia, where their number is more than 2 times higher. Montenegro, Romania and North Macedonia have a larger population of gig workers in two areas each (Montenegro: sales and marketing and writing and translation; Romania: professional services and writing and translation; North Macedonia: data entry and administrative services and writing and translation), while only in Serbia is the population of gig workers smaller in each of the observed 6 professions.

Regarding the most popular profession, three professions dominate the market for gig workers. Namely, gig workers are most represented in writing and translation in four countries: Bosnia and Herzegovina, Croatia, Hungary and Romania, multimedia and creative services in three: Bulgaria, Montenegro and Serbia, and data entry and administrative services in two: Albania and North Macedonia. When it comes to the male gig population, the situation is much more monolithic: gig workers are most represented either in creative services and multimedia (Bosnia and Herzegovina, Montenegro, Croatia, North Macedonia and Serbia) or in software development (Albania, Bulgaria, Hungary and Romania). This distribution leads to the conclusion that the female gig population is much more diverse among the countries of the region.

HOURLY RATES, IN US$

Although the average labor price recorded an increase of 26 cents per hour, which is an acceleration compared to the previous measurement. However, given that it only increased by 1.25%, it is more correct to state that wages are largely stagnant over the past two years. The changes are though very different when observed at the level of individual countries. Namely, Croatia is no longer the country with the most expensive workforce ($23.7/h), but Hungary ($23.8/h). This is the result of two factors: a smaller part due to the drop in the average labor price in Croatia and a larger part due to the increase in wages in Hungary. North Macedonia not only remained the country with the cheapest labor force in the region on average, but it is one of the 3 countries where the average hourly labor price has fallen (apart from the mentioned Croatia, this is also the case with Bulgaria). How big the differences are is best evidenced by the fact that a gig worker from Hungary works half a month to achieve the average monthly salary (measured according to the number of possible working hours in a regular employment relationship and the average price of gig work per hour in Hungary) earned by a gig worker from North Macedonia. Read more ...

When it comes to the average hourly salary, there are differences between countries. In the countries where the average wages grew, the most pronounced growth was in Montenegro, where wages per hour increased by $1.1 – monthly. It represents an additional income of almost US$ 200. All other countries recorded more moderate income growth – from 26 cents in Romania to 71 cents in Hungary. If the trends are observed with those from the previous year, the countries that continuously had an increase in average hourly earnings are: Montenegro, Hungary, Romania and Serbia.

Convergence in earnings between the sexes continued: on average, women in the region earned 85.3% of the average earnings of gig workers. According to this indicator, the region is significantly ahead of the global average: the global average is 82% globally according to the Payoneer survey, that is, only 52% according to the Bloomberg survey in the USA, country with the most developed digital labor market. Female gig workers, on average, earned US$ 3.16 less than male gig workers in the most recent survey, but that difference narrowed by 26 cents compared to the previous survey. While convergence in earnings is present at the regional level, differences appear at the level of individual countries. Namely, Albania, Montenegro and Hungary are countries where the gap between women and men has deepened compared to the previous measurement. In all other countries, there has been a convergence, that is, a reduction in the differences in earnings between the sexes. Despite the wage gap between gig workers and gig workers, Albania is still the country with the most egalitarian labor price: women earn on average 89.4% of the average wage of gig workers. The most pronounced inequality is present in Croatia – female gig workers earn only 80% of the wages of gig workers. The situation is somewhat more favorable in Montenegro (81.3%) and Hungary (82.3%), while in other countries the values are higher than the regional average: 85.7% in Bosnia and Herzegovina, 86% in Romania, 86.1 % in North Macedonia, while Serbia is right behind Albania with 86.5%.

_____________________________________________________

Recommended citation: Anđelković, B., Jakobi, T., Ivanović, V., Kalinić, Z. & Radonjić, Lj. (2022). Gigmetar Region, October 2022, Public Policy Research Center, http://gigmetar.publicpolicy.rs/en/region-en-2022-2/.

PREVIOUS REPORTS

HOW GIGMETAR WORKS

GigmetarTM is the first instrument that describes the geography of digital work in Serbia and the region in terms of gender, income, and most common occupations. It is a result of the efforts made by the Public Policy Research Centre (CENTAR) to shed more light on the work on online platforms.

ABOUT US

The Public Policy Research Centre (CENTAR) is a team of innovative researchers and digital enthusiasts investigating the future of work and development of the digital economy in Serbia and South-East Europe.

Contact: gigmetar@publicpolicy.rs